sports betting in ct taxes

Winnings over 5000 are often taxed automatically. Gambling losses can be deducted.

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Thats good for an effective tax rate of.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/IEAYBNYQ3EEMAJ2EFQUUF2WBYQ.aspx)

. There are circumstances where a nonresident who receives 5000 or less in Connecticut Lottery winnings will be subject to Connecticut income tax if the proceeds from a wager. Gambling winnings are fully taxable under the state income tax. 10 online 8 retail.

This law applies to all CT Lottery. The passage of legal sports betting in CT has removed all previous bans and has now opened the door for offshore sportsbook sites to operate within Connecticut without. Penalties for not reporting sports-betting income.

Facilities are required to withhold 24 of your earnings for. Online casino gaming and sports betting has been live in Connecticut since Oct. Winnings from all other types of gambling in the state are tax.

If the winner is a resident of Connecticut and meets the gross income test all gambling winnings are subject to Connecticut income tax to the extent includable in the winners federal adjusted gross income. 13 of first 150 million then 20. By law nonresidents owe Connecticut income tax only on Connecticut state lottery winnings exceeding 5000.

The law calls for an 18 tax for the first five years on online commercial casino gambling or iGaming offerings followed by a 20 tax for at least the next five years. Since the inception of legal sports betting in 2018 the Garden State has collected 1695 million in taxes from 135 billion in sports betting revenues. State law in Connecticut requires prize grantors to withhold 699 on all gambling winnings that are either.

Winnings that hit the 600 threshold will be taxed at a 24 rate. The state income tax unlike the federal tax does not allow a taxpayer to use gambling losses to offset taxable. If you itemize your tax deductions you will be able to deduct.

Whether gambling winnings are subject to Connecticut income tax depends on whether or not the winner is a Connecticut resident. Its a fantastic place to gamble as the Tennessee sports betting tax rate is 0 meaning those winning money in Tennessee will only be required to pay the standard federal tax. If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it.

If the winner is a resident of Connecticut and meets the gross income test below all gambling winnings are subject to Connecticut income tax to the extent includable in the winners federal adjusted gross income. After rejecting a sensible proposition approved by the. Connecticut state taxes for gambling.

It is projected to. This gambling tax by state depends on the type of gambling for example the gambling winnings state taxes. Connecticut income tax will not be withheld from gambling winnings if the payer does not maintain an office or transact business in Connecticut if the payment is not subject to federal.

Those taxes can come either at the time the winnings are paid out in the form of withholding from the casinos. Sports Betting Taxes Take-Aways. Reportable for federal tax purposes OR.

The state will collect taxes of 18 initially on online casino gambling increasing to 20 after five years. Whether gambling winnings are subject to Connecticut income tax depends on whether or not the winner is a Connecticut resident resident. There simply was not enough bandwidth in the Senate to handle sports betting President Karen Spilka said in October.

Gambling winnings are typically subject to a flat 24 tax. Colorado has a flat-rate tax of 463 for most gamblers. Of course the IRS wants you to report all your taxable income and if you dont you could face penalties and interest on any tax.

How States Tax Sports Betting Winnings. The good news about sports betting taxes is that you can deduct losses up to the amount of wagering winnings. And 1375 on sports betting and fantasy sports.

19 and the state reported that its tax coffers gained a total of 17 million in about a half-month of. However for the activities listed below winnings over 5000 will be subject to income tax withholding. Sports betting profits are taxed at a rate around 24.

Subject to federal withholding tax.

Gambling Pays Out A 38 Billion Bonus To Tax Collectors Winning Lottery Numbers Lottery Numbers Lotto Numbers

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/IEAYBNYQ3EEMAJ2EFQUUF2WBYQ.aspx)

Sports Betting Will Begin Early In Nfl Season After Connecticut Lottery Picks Vendors To Run Online Gambling And Sports Betting Venues Hartford Courant

Connecticut Lawmakers Approve Sports Betting Here S When And Where You Can Place Bets

Sports Betting Online Gambling On Hold In Connecticut After Procedural Issue Takes Longer Than Expected Politics Government Journalinquirer Com

Legal Sports Betting Brought In 4m For Connecticut During Its First Full Month

December Gambling Revenues Show Online Casino Gaming Trumps Sports Betting Connecticut Public

Lawmakers Drill Down On Problem Gambling Nbc Connecticut

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Connecticut Lottery Corp Launches First Retail Sports Betting Site Another 14 Gambling Locations Are Planned Hartford Courant

Connecticut Launches Sports Betting To Modest Crowds

How Will Legal Sports Betting Affect Your Income Taxes Credit Karma Tax

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Tennessee Online Sports Betting Which Mobile Sportsbook App Is Best

Ct Collects Nearly 2 Million In First Month Of Online Gaming And Sports Betting Nbc Connecticut

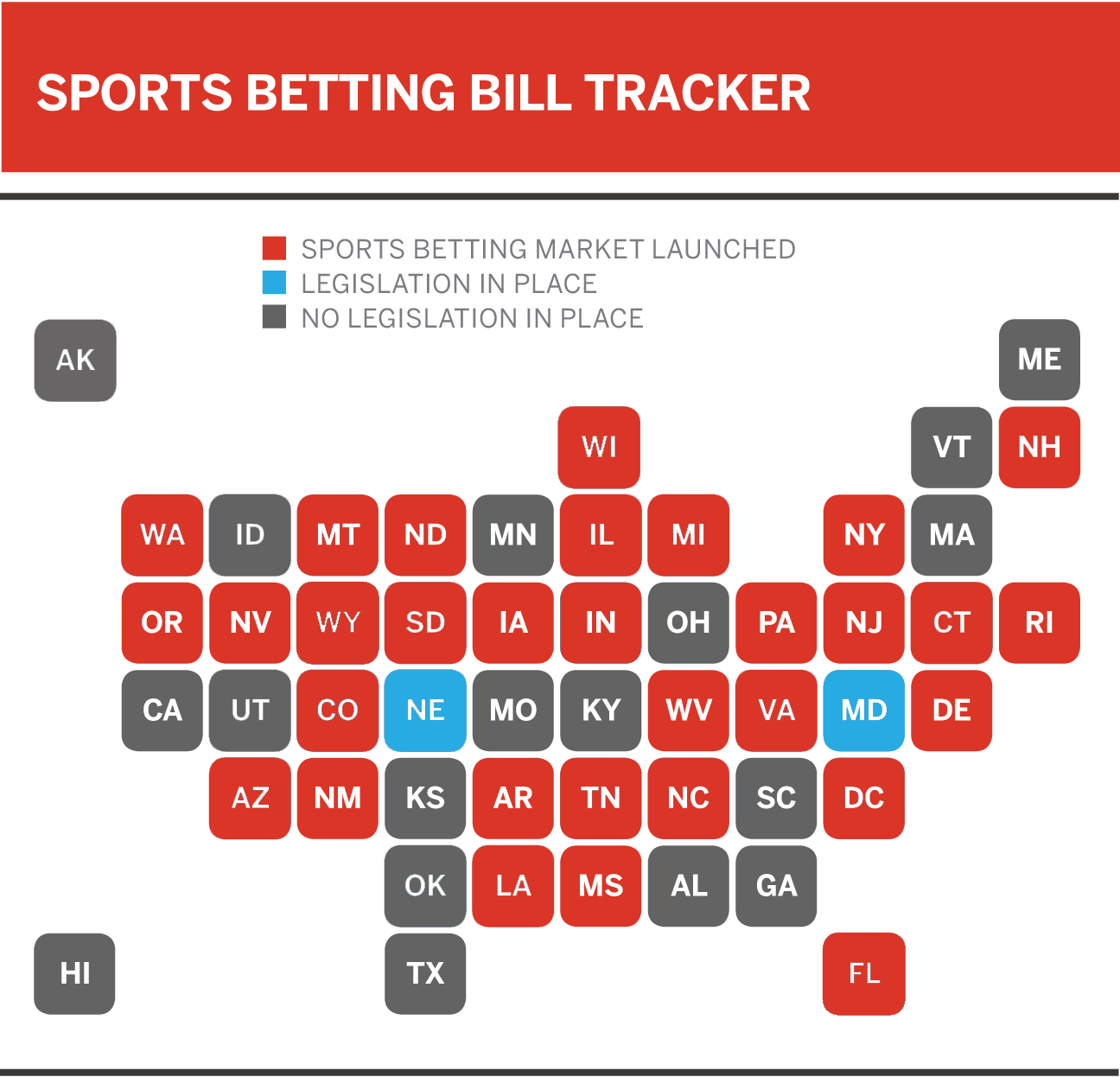

The United States Of Sports Betting Where All 50 States Stand On Legalization

Sports Online Gambling To Start In October Ct News Junkie

Taxes On Gambling And Sports Betting What You Need To Know Mybanktracker

Before Sports Betting Opens Connecticut Addresses Problem Gambling

Sports Betting Taxes Guide How To Pay Taxes On Sports Betting The Turbotax Blog